How Much Time Must a Company Hold Pay Stubs?

What is the minimum amount of time that a firm must retain pay stubs? is one of the most often asked concerns concerning payroll record management.

The best practices for maintaining financial records and regulatory requirements are just two of the variables that affect the response.

We at Pay-stubs.com recognize the value of precise and effective payroll processing. By making this procedure easier, our pay stub generator makes sure that your company remains structured and compliant.

We’ll talk about the ideal storage practices for payroll records, such as pay stubs, in this blog article.

Now let’s get going!

Employers (medium-sized to big) are encouraged by the Internal Revenue Service (IRS) to retain employment tax records for a minimum of four years after the date of payment or the tax’s due date, whichever comes first.

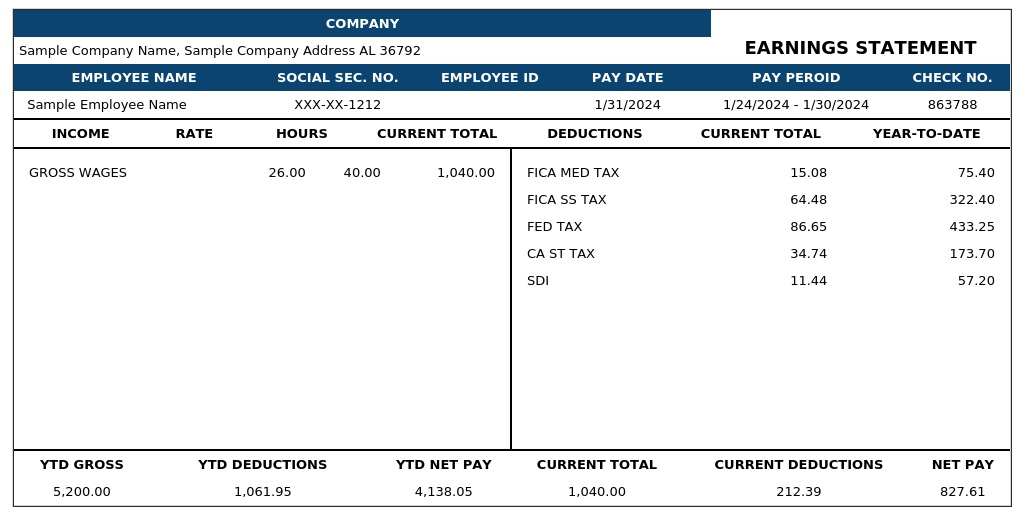

These documents, which comprise paystubs and time (hours worked), are essential for confirming the correctness of tax filings.

The Fair Labor Standards Act (FLSA) and the Equal Employment Opportunity Commission (EEOC) have precise recordkeeping requirements, so maintain copies of your paystubs for as long as necessary.

They require employers to retain all personnel, employment, and salary records for a maximum of two years beyond the date of termination of employment.

Records pertaining to involuntary terminations must be kept on file for at least a year following the termination date. The rules apply to small firms as well.

In accordance with IRS regulations, we advise retaining all of your financial records—including tax returns and pay stubs—for a minimum of four years.

However, it is preferable to retain records for a minimum of six years if there are unreported profits exceeding 25% of the gross income indicated on your return.

Once year-end statements are obtained, monthly statements and pay stubs can be destroyed.(Source:real pay stubs)

Payroll records: How Should They Be Stored?

Document

Even though digital storage is becoming increasingly common, payroll data are still kept on paper by some smaller to medium-sized enterprises.

In the event that you decide to retain hard copies of your pay stubs, you must have a safe and well-organized file system.

We advise utilizing secured file cabinets and granting only authorized people access. This approach guarantees that documents are freely available for audits or reference in addition to protecting sensitive data.

Digital

We strongly advise making the switch to digital record-keeping as it provides better security and accessibility.

Digital copies of pay stubs may be kept on safe servers or in the cloud or in your computer.

Digital documents save space and provide better organization and speedier retrieval.

Furthermore, this is a far more ecologically beneficial course of action.

Thanks for reading this post. Use our free paystub generator today for creating your pay stubs.