Not Having Pay Stubs in Time for The House Closing? Here’s What You Need to Do!

The situation of “closing on house and not having pay stubs in time for closing” may provide a challenge while attempting to purchase a new home.

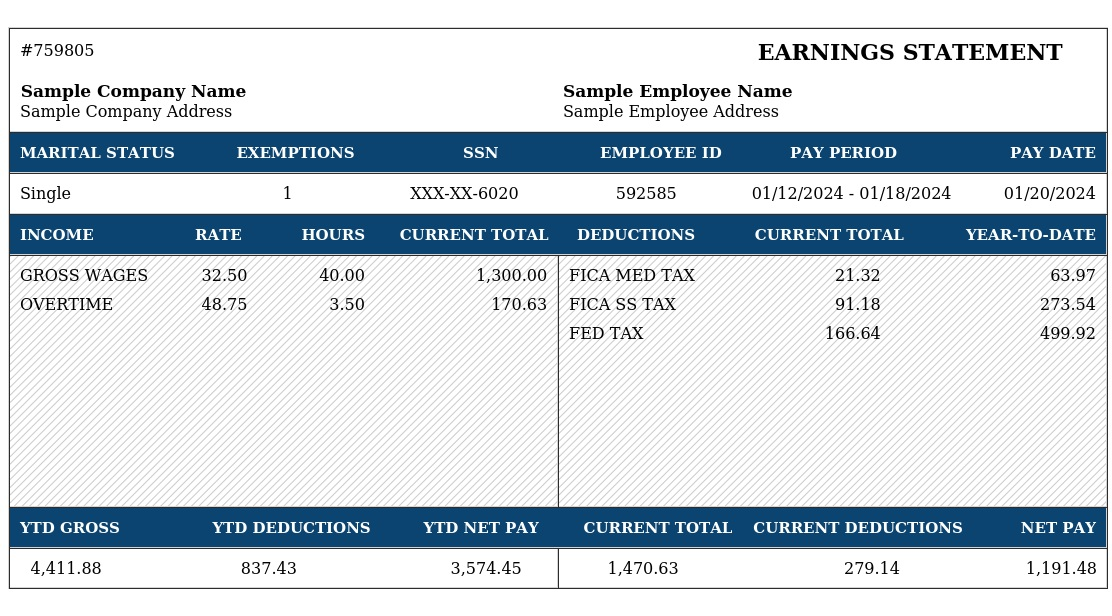

In order to confirm that purchasers have the financial stability for such a big purchase, lenders and sellers frequently use pay stubs required for a home to verify income. You could miss out on your ideal house or experience delays without them.

We’ll explore the importance of pay stubs for house closing in this guide. We’ll also talk about the possible consequences of not having your pay stubs ready and how our experience can help you prevent any delays so that you can move smoothly and stress-free toward homeownership.

Are Pay Stubs Requested by Lenders During Home Closing?

At home closings, lenders frequently ask to see the most recent pay stubs to make sure the buyer’s financial status hasn’t changed significantly.

Based on our experience, this procedure is typical and acts as a last check to validate the buyer’s steady income, which is crucial for the mortgage approval procedure.

As part of their due diligence to safeguard their investment and ensure that you can reliably make mortgage payments, the lender has to take this important step.

How Much Time Pay Stubs Are Valid Prior to a Home Closing?

Pay stubs are good for a different amount of time before a house closing, but for a house closing, lenders usually need pay stubs that are no older than 30 to 60 days.

This time span, in our opinion, ensures that the data on one or more paystubs is up to date and appropriately represents your financial status at the time of purchase.

To make sure there haven’t been any changes to the buyer’s employment or income, realtors frequently request the most recent pay stub just before closing.

Our pay stub generator can help you and other buyers avoid any closing-process delays and ensure a more seamless transition to homeownership.

You Can Forfeit the Funds Required for the Down Payment on Your Home

The possible loss of the down deposit is among the most immediate financial repercussions of a postponed or canceled home closing.

Large deposits are frequently made by buyers to guarantee their acquisition. Depending on the details of the agreement, not closing on time may result in the loss of this money.

How to Prevent Pay Stubs from Causing House Closing Delays?

At the beginning of the house closing process, gather pay stubs and other pertinent documents.

Start by gathering all of the paperwork the lender needs, such as:

- tax returns, current pay stubs, and any other financial records attesting to your income

This proactive strategy guarantees that you are ready for any requests that may come up during the house closing process by drawing on our experience.

This process may be streamlined with the use of our paystub generator, which will provide correct and polished documentation all at once.