Demystifying Pay Stubs: Frequently Asked Questions

Pay stubs play an essential role in the employer-employee relationship, serving as a tangible record of compensation and deductions. Yet, despite their importance, questions often linger around the intricacies of pay stubs. In this article, we aim to demystify the frequently asked questions surrounding pay stubs, shedding light on their purpose, components, and common concerns.

1. What Constitutes a Pay Stub, and What Significance Does It Hold?

A pay stub, also known as a paycheck stub or pay slip, is a document provided by employers to employees along with their paychecks. It outlines the details of the employee’s earnings and deductions for a specific pay period. The importance of a pay stub lies in its transparency, offering employees insight into how their wages are calculated and where their money is allocated.

2. What Details Are Typically Found on a Pay Stub?

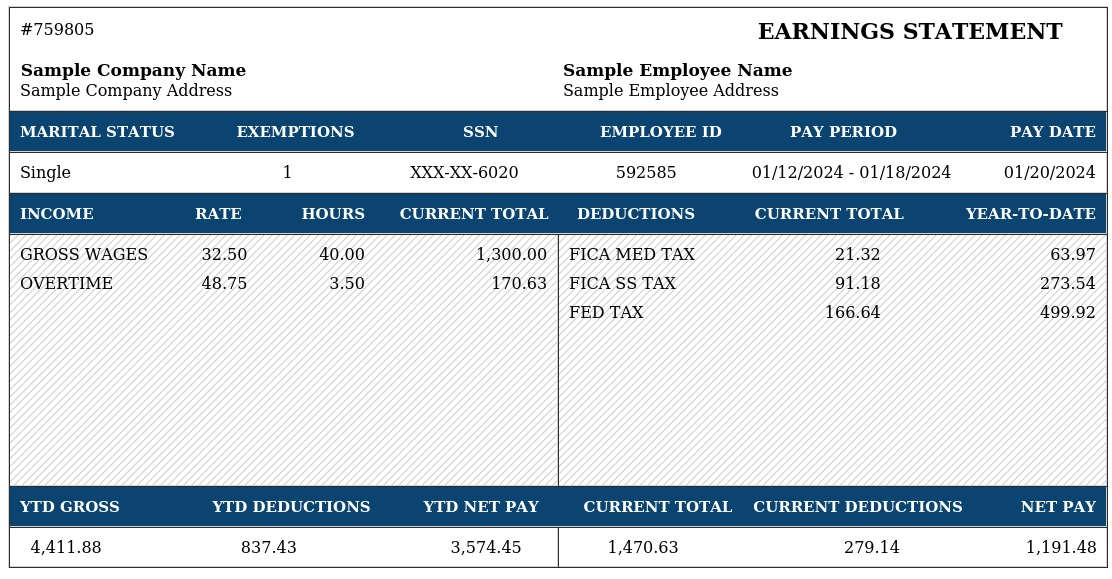

A typical pay stub includes a plethora of information:

Gross Earnings: The complete sum earned prior to any deductions.

Net Earnings: The amount received after deductions, often referred to as take-home pay.

Deductions: Deductions encompass various items such as taxes, insurance premiums, retirement contributions, and other withheld amounts.

Taxes: Breakdown of federal, state, and local taxes withheld.

Benefits: Contributions to health insurance, retirement plans, and other benefits.

Year-to-Date (YTD): Cumulative totals for earnings, deductions, and taxes from the beginning of the calendar year.

Understanding these elements is important for employees to measure their financial status and ensure the accuracy of their compensation.

3. How Often Should I Receive a Pay Stub?

Employers are typically required to provide employees with a pay stub each time they are paid. This frequency may vary depending on the employer’s pay schedule, which can be weekly, bi-weekly, semi-monthly, or monthly.

4. Can I Access My Pay Stubs Online?

Many employers offer the convenience of online access to pay stubs through secure employee portals. This allows employees to view and download their pay stubs at their convenience, promoting efficiency and reducing paper waste.

5. What Should I Do If There’s an Error on My Pay Stub?

If you spot an error on your pay stub, it’s crucial to address it promptly. Notify your employer’s payroll or human resources department to rectify the mistake. Common errors include inaccuracies in hours worked, incorrect deductions, or overlooked bonuses. Prompt communication ensures that discrepancies are resolved promptly. (Source-free paystub generator)

6. Can I Use My Pay Stub to File Taxes?

While a pay stub provides valuable information, it is not the primary document for filing taxes. Employees receive a W-2 form from their employer at the end of the tax year, summarizing annual earnings and tax withholdings. The W-2 is the document used for filing federal and state income taxes.

8. Why Are There Different Deductions on Pay Stub?

Deductions on a pay stub serve various purposes, including taxes, insurance premiums, retirement contributions, and other voluntary deductions. Understanding each deduction is essential for employees to comprehend their financial obligations and benefits.

Conclusion: Empowering Employees with Pay Stub Knowledge

Understanding the intricacies of pay stubs is essential for both employees and employers. By addressing frequently asked questions, individuals can navigate the complexities of payroll information with confidence, ensuring accurate records and financial transparency. Generate pay stubs with our paystub generator at Pay-stubs.com.