Payroll Taxes in the USA: A Guide to Understanding Your Taxes

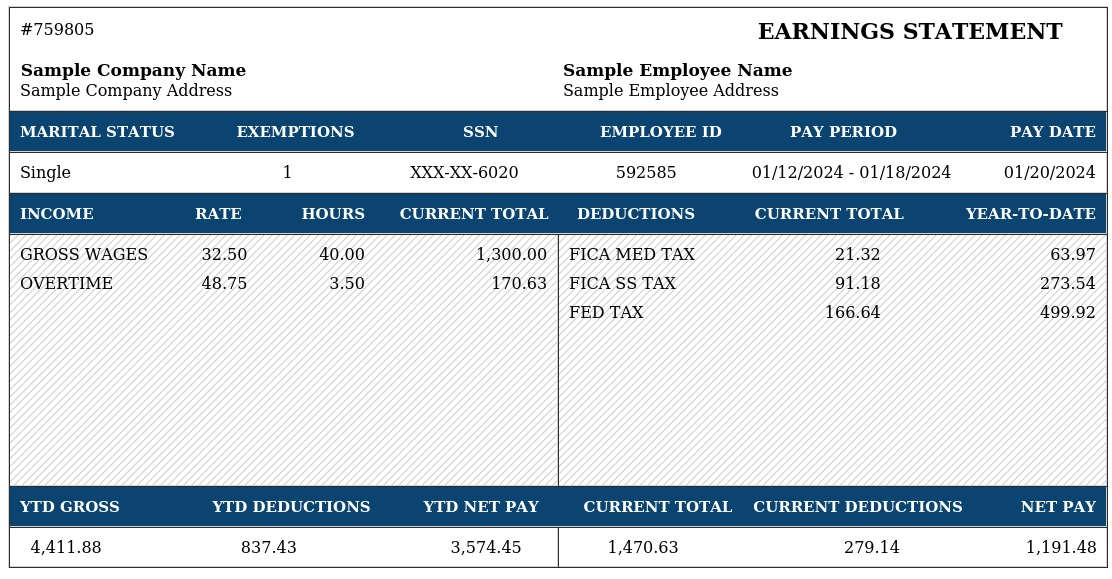

Payroll taxes refer to the funds that are subtracted from employees’ salaries to cover federal and state income tax, Social Security, Medicare, and unemployment contributions. The exact amount withheld is based on factors such as an employee’s earnings, the number of dependents they have, and the state in which they work.

Employers are obligated by the IRS to deduct Social Security and Medicare from their employees’ wages. It is also advisable for employers to deduct federal and state income taxes from employee paychecks as these taxes can be used as deductions on the employee’s yearly income tax filing.

Federal income taxes must be deducted from the pay of every employee, whether they work full-time or part-time, are paid by the hour or receive a salary. This rule applies to all individuals who earn more than $2000 within a given year. Employers are required to withhold these taxes, regardless of whether they believe an employee will owe any taxes when they file their personal income tax return at the end of the year. The percentage of federal income tax withheld varies from 10 percent to 37 percent, depending on the employee’s annual earnings.(Source: check stub maker)

Employers are required to allocate funds to the government as workers, and employees themselves also contribute to this tax. To be more precise, payroll taxes encompass federal and state income taxes, in addition to the Social Security and Medicare taxes that employers pay.

The Social Security tax rate is 6.20%, medicare tax is 1.45% for both the employee and the employer. The federal income tax rate can range from 0% to 35%.

Calculating payroll taxes involves deducting a specific type of tax directly from the wages of an employee by the employer. These taxes comprise federal income tax and Medicare tax, which are taken out of the employee’s paycheck.

To determine the monthly payment for payroll taxes, you can multiply the overall gross wages by the current Social Security tax rate. However, the calculation for Medicare tax is more intricate as it depends on factors like marital status, filing status, and the presence of any dependents residing with you.

Employers have the responsibility of deducting payroll taxes from their employees’ earnings and forwarding them to the government on behalf of the employees. These taxes are used to fund various public programs, including social security, Medicare, and, in some states, federal, state, and local income taxes.

Thanks for reading this post. Looking for a free paystub generator? Visit Pay-stubs.com today!