Why Is Examining the Data on a Paycheck Stub Important?

Comprehending the significance of scrutinizing the data on a paystub is imperative for effective money handling and precise income reporting.

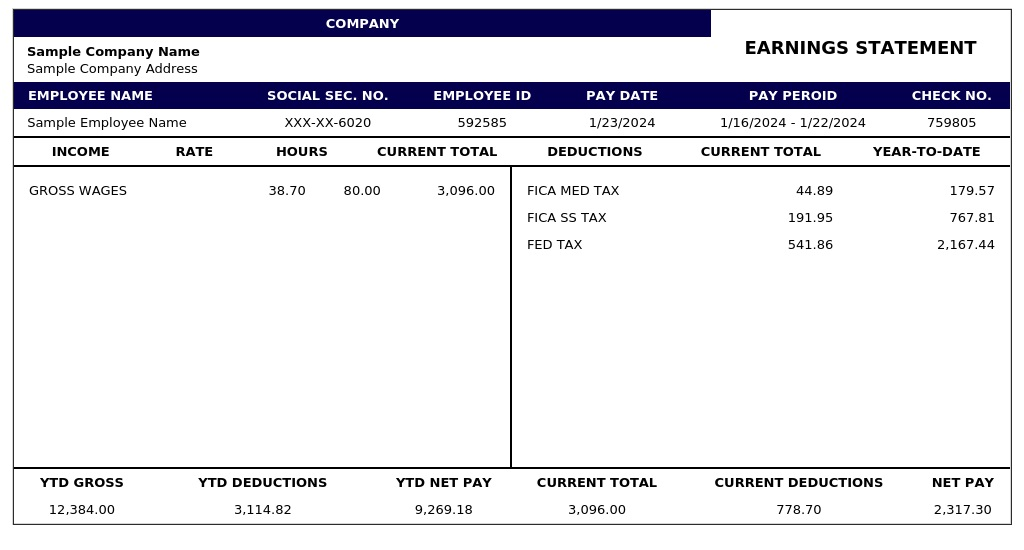

It goes beyond simply checking your online pay stubs to confirm your earnings; it also involves making sure all of your expenses, including taxes and perks, are correctly deducted.

Motives for Examining Your Pay Stub

You should always verify your real pay stubs or check for a variety of reasons.

Customize Your Taxes

Examining your pay stub enables you to efficiently customize your taxes.

When you make pay stubs using Pay-Stubs.com, we can assist you in quickly and simply identifying essential facts, ensuring that your taxes are exactly as they should be.

Appropriate Withholding

Ensuring that the correct amount is withheld for taxes is crucial for maintaining financial stability, and this may be achieved through proper withholding.

Steer clear of errors and underpayment

Paystub errors are a typical occurrence, especially during the employer verification procedure.

According to our research, routinely checking your pay stub can assist in identifying problems in:

- Salary

- Hours Worked

- Overtime Computation

This attention to detail ensures that you receive the precise amount due based on the hours per week listed on your pay stub.

We handle all of the labor-intensive work and computations when you use Pay-Stubs.com, making sure that your pay stubs correctly reflect your financial data.

Determine Your Tax Burden

Planning your finances requires an understanding of your overall tax burden. This entails understanding the amount deducted for state, and federal taxes.

You may more successfully manage your money each year by identifying your tax burden on your pay stubs with our pay stub maker.

Recognize Your Entire Workday And Paid Time Off

It’s critical to monitor your paid time off and working hours.

Our research showed that you can confirm you are getting paid for all the hours you have worked, including overtime, by looking over your pay stub. It can also guarantee that the time off you have been compensated for is accurately documented.

Accurately Calculate Benefits

A portion of your salary is deducted for benefits including health insurance, retirement contributions, and employee Medicare on your pay stub.

Make sure these deductions are accurate and not greater than they should be by always double-checking them. In this manner, you may prevent having a detrimental effect on your budget and financial planning.

We have addressed the topic of “Why Is Examining the Data on a Paycheck Stub Important” in this post. Use our easy-to-use free paystub generator to make your pay-stubs now!