Demystifying W-2 Forms – A Comprehensive Guide to Understanding and Accessing

Curious about the elusive W-2 form and its intricacies? In simple terms, the IRS Form W-2 is a comprehensive wage and tax statement designed to outline your taxable wages and the corresponding taxes withheld. However, a glance at the W-2 form reveals a maze of information, with numerous lines, boxes, and codes extending beyond a mere display of taxable wages.

Unpacking the complexities of the W-2 form can be overwhelming. Whether you seek a brief overview or an in-depth analysis, we are here to assist you in comprehending the nuances of your W-2 form.

When Do You Get Your W-2?

Your employer is obligated to furnish you with a W-2 Form by January 31 each calendar year. Additionally, a copy of your W-2 form is forwarded to the Social Security Administration (SSA), Internal Revenue Service (IRS), and relevant state or local governments where taxes are withheld or wages are subject to taxation. Create w2 online free.

Understanding Your IRS W-2 Form

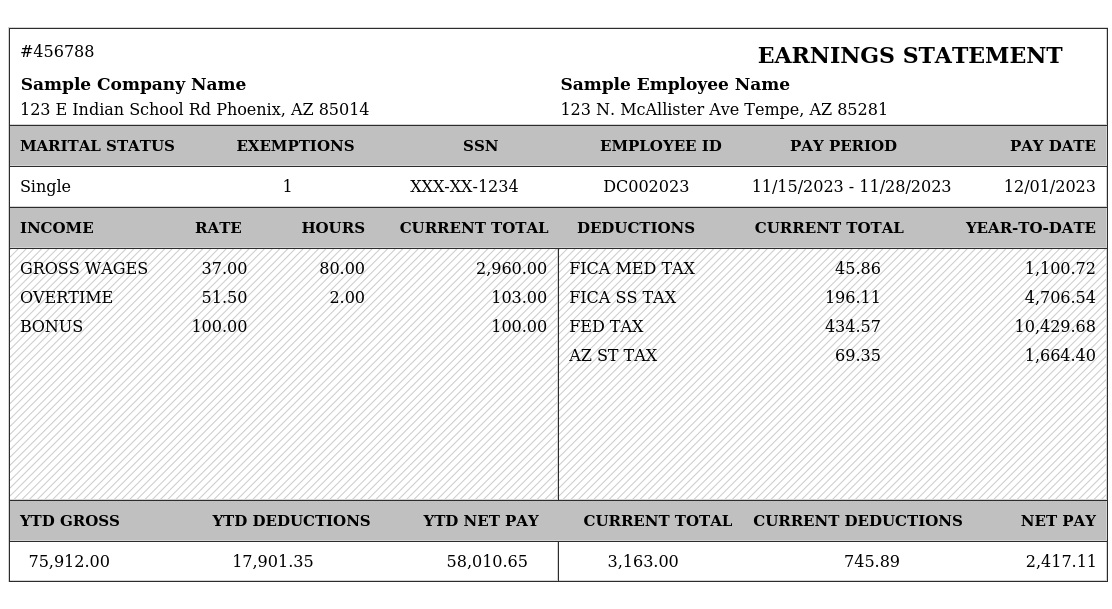

Given the myriad of codes and boxes on a W-2 form, decoding it can pose a challenge for some. For those seeking a breakdown, refer to resources on W-2 box codes or delve into the intricacies of W-2, box 12. For a more streamlined overview, the W-2 typically encompasses:

Personal and Employer Information: This section includes essential details such as tax identification numbers and addresses.

Wages and Taxes: Covering actual income, federal income tax, and Social Security and Medicare taxes – the core components of an IRS W-2 form.

Convenience: Details concerning retirement plans, insurance plans, dependent care benefits, and health savings accounts. Note that these may not appear if your employer doesn’t provide such benefits.

State and Local Returns: Inclusion of income and tax withholding information for your home state and any other states of employment, along with pertinent local tax details.

Payment Information for Other Items: Incorporating union dues, sick leave, tuition assistance, charitable giving, and certain fringe benefits.

For additional guidance on interpreting a W-2, seek further assistance.

What to Do With Your W-2 Form?

Whether you embark on the tax filing process independently or enlist the help of a tax professional, your W-2 is a crucial starting point. Many of the provided amounts will find their place on your federal tax return or state tax return.

How Can I Get My W-2 From a Previous Employer?

Getting a W-2 from a single employer within a tax year is typically simple. However, if you’ve had multiple employers, the question arises, “How can I get my W-2 from a previous employer?” Your former employer is mandated by the IRS to mail you a copy before January 31. In case of non-receipt during this period, proactive measures are necessary.

Initiate contact with your former employer, starting with the HR department or payroll office. If you were employed by a smaller company, contact your direct supervisor. Confirm that they sent the form to the correct mailing address, and if not, request a resend via email, mail, or a secured employer portal. Alternatively, consider picking it up if you are near your former workplace.

If communication with your former employer proves challenging or unfruitful, and you haven’t received the form by the end of February, contacting the IRS becomes the next step.

How Can I Get My W-2 Online for Free?

In the digital age, the prospect of obtaining your W-2 online for free is appealing. Fortunately, PayStubs offers free pay stubs, allowing many taxpayers to generate their W-2 online at no cost. Explore the convenience of generating paycheck stubs instantly at Pay-stubs.com, using their paystub generator with a logo for added security and fraud prevention. Try the real pay stub maker with your company’s logo now.