How to Make Pay Stubs for Employees?

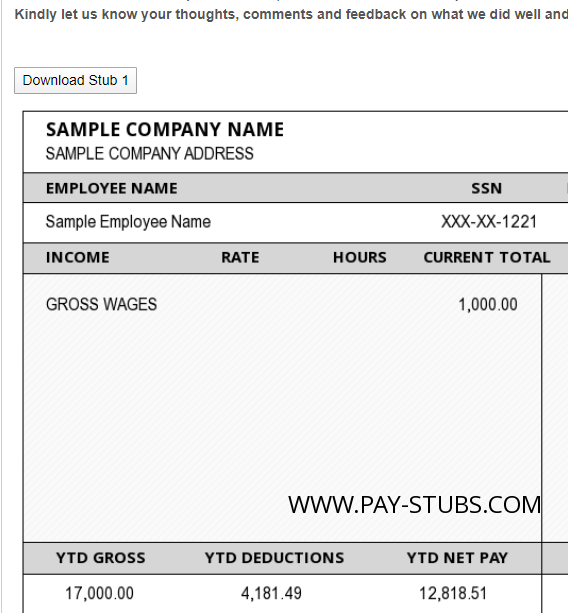

A paycheck by itself does not offer employees with critical details that they may wish to keep track of, together with what taxes were taken out, the quantity of the taxes, hours labored, and 12 months-to-date fee records.

In addition, many employees will need their pay stubs when applying for a mortgage, refinancing a house, or filling out their baby’s university financial useful resource bureaucracy. Employers can create a pay stub to go with the worker’s paycheck by downloading a loose pay stub template or by developing their personal template on an online utility(pay-stubs.com).

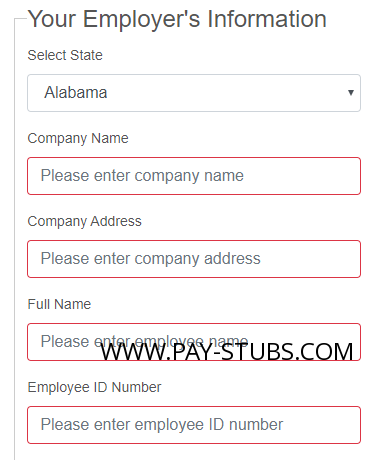

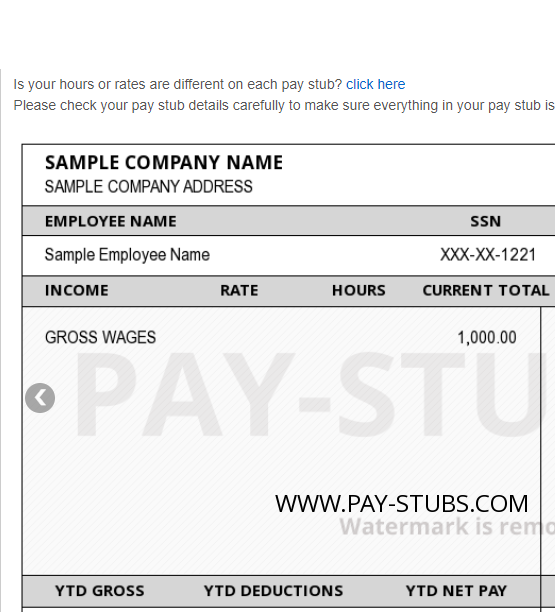

, To begin, open your web browser and search for Google Pay-Stubs.com. Next, click on Pay-Stubs.com and select the pay stub template, and then enter the agency name and address, the worker’s full name, and the worker’s Social Security number at the top left-hand side of the pay stub. Across from these records is a list that includes the pay period and the date the paycheck was written. List the charge for pay, together with the fee for time beyond regular hours, underneath the worker’s call. Follow that with the number of ordinary hours and overtime hours worked on the next line. Go to the following line to list any deductions taken from the wages. These can also include federal taxes, kingdom taxes, Medicare, Social Security, incapacity, or even medical insurance. Finish the pay stub by using a list of all year-to-date records. Print and distribute the pay stub to the worker alongside along with his paycheck.