Pay Stub 101: Your Simple Guide to Decoding, Resolving, and Accessing Paycheck Records!

Pay stubs, also referred to as pay statements or wage statements, act as the deciphering tool for payroll, aiding employees in understanding the intricacies of their paychecks. These documents hold significant value not only for employees seeking clarity on their earnings but also for employers navigating wage and hour disputes or addressing tax-related issues. The role of pay stubs can vary depending on state regulations, with some states mandating specific information for payroll compliance.

What Is a Pay Stub?

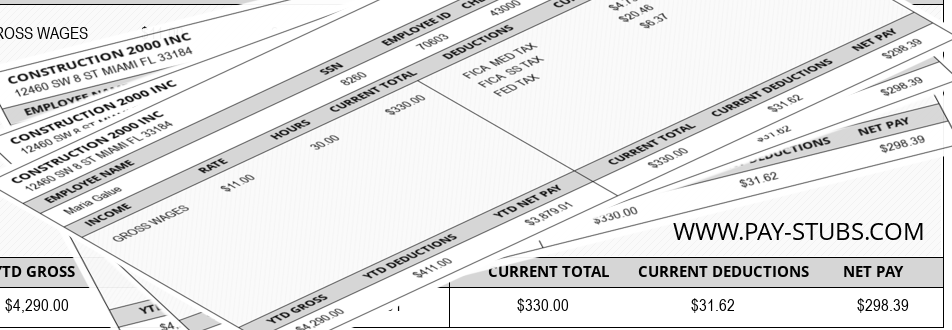

A pay stub is essentially a document that provides a concise summary of an employee’s financial transactions related to their employment. It encompasses crucial details such as gross pay, taxes, deductions, and net pay. Pay stubs can be delivered in printed form along with a physical paycheck or made accessible electronically. Certain states may require employees to provide consent before receiving electronic pay statements.

Significance of Pay Stubs

Deciphering Paychecks

Pay stubs act as a key tool for employees to decode the details of their paychecks. From gross earnings to net pay, taxes, and deductions, every aspect is meticulously outlined.

Resolving Disputes

Employers find real pay stubs invaluable in resolving wage and hour disputes. When discrepancies arise or queries about tax-related matters surface, the pay stub serves as a comprehensive record.

Tax Compliance

Pay stubs are often an integral part of payroll compliance, varying from state to state. They contribute to maintaining transparency and ensuring adherence to tax regulations.

The Versatile Uses of Pay Stubs

Your pay stub is not merely a document for personal reference but a versatile record that finds applications in various scenarios:

Leveraged by Lenders

Financial institutions and lenders rely on pay stubs to gauge an individual’s creditworthiness. Analyzing the pay stub helps in assessing the potential debt an individual may be eligible for, whether it’s for a home, car, education, or other financial needs.

Employment History Verification

Recruiters and potential employers refer to pay stubs to verify an individual’s employment history. Accuracy in displaying name, employer details, and employment dates is paramount, as it influences salary offers and benefit calculations.

Ad Hoc Purposes

Pay stubs serve ad hoc purposes such as maintaining a personal history, using it for identification, establishing witness accounts, or even in legal contexts like prenuptial agreements.

Obtaining Your Pay Stub

Getting access to your pay stub doesn’t have to be a cumbersome process. While it might not be mandatory in all jurisdictions, here are some simple ways to obtain your pay stub:

Communication with HR or Employer

Engage with your Human Resources team or Employer, as they likely have access to records of payslips or similar documents. Remember to communicate your specific purpose for needing the pay stub, as this information can help your employer provide the necessary documents more efficiently.

Pay-stubs.com

For those seeking a hassle-free and cost-effective solution, Pay-stubs.com stands out as a reliable platform. The online Pay Stub Maker allows self-employed individuals to effortlessly generate pay stubs. With a 1099 pay stub template available for free, users can customize and download professional pay stubs that accurately reflect their financial situation.

Visit Pay-stubs.com today and experience the convenience of generating pay stubs effortlessly.