5 Reasons Why Creating Pay Stub For Small Business is Essential

Payroll management can be a daunting task for small business owners. Hence, Pay Stub for Small Business comes to the rescue. The Pay Stub Generator provides employees with a comprehensive summary of their earnings, deductions, and taxes.

Moreover, it offers a structured breakdown of their compensation, allowing them to understand the different components that contribute to their net pay. This level of detail empowers employees to make informed financial decisions and effectively manage their personal finances.

By having a clear overview of their earnings and the various deductions applied, employees can better plan for expenses, savings, and investments.

In this article, we’ll look into five crucial reasons why integrating a paystubs system into your small business’s payroll can streamline operations, save time, and ensure accuracy.

Understanding Pay Stubs

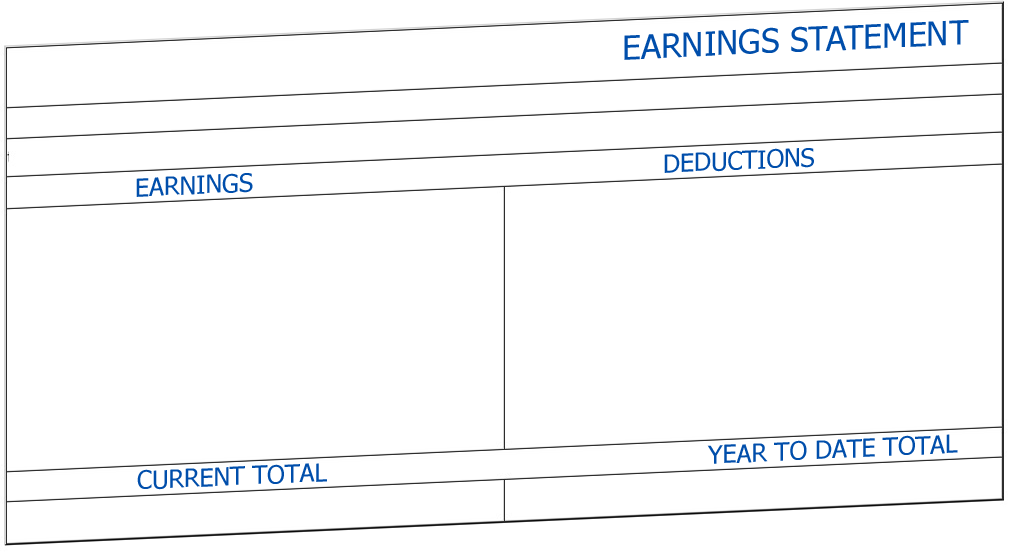

Before understanding the importance to Create Pay Stub for small businesses, let’s understand its meaning. A pay stub, also known as a paycheck stub or earnings statement, is a document provided to employees along with their paychecks.

It provides a detailed breakdown of an employee’s earnings and deductions for a specific pay period. Pay stubs typically include information about gross wages, taxes withheld, deductions, and net pay.

- Offers Detailed Information to Employees:

Transparency in payroll is crucial for maintaining employee satisfaction and trust. Paystub Services provide a clear breakdown of an employee’s earnings, deductions, and taxes. This transparency empowers employees to understand their compensation and raises awareness about the financial aspects of their employment. It also helps in addressing any discrepancies promptly.

- Reduce the Risks of Errors:

Errors in payroll not only lead to unhappy employees, but can also incur significant financial losses for your business. Mistakes in tax calculations or missed deductions can result in fines and penalties. Integrating a pay stub system minimizes these risks by automating calculations and ensuring compliance with tax regulations, ultimately saving your business from unnecessary expenses.

- Enhanced Data Security and Confidentiality:

Manual payroll processes involve the handling of sensitive employee information. This poses a security risk, as mishandling data can lead to breaches and privacy concerns. A Pay Stub System provides a secure digital platform to store and manage payroll information, reducing the risk of data leaks and unauthorized access.

- Increase Precision in Payroll Calculations:

Accurate payroll calculations are paramount to maintaining trust and harmony within your team. With manual calculations, the chances of errors are higher, leading to dissatisfied employees and potential legal issues. Pay stubs generated through automated systems guarantee precise calculations, ensuring that each employee receives the correct compensation they deserve.

- Scalability and Growth Facilitation:

As the small business grows, it becomes more difficult to manage payroll. Implementing a pay stub system early on prepares your business for scalability. Automated systems can easily handle an expanding workforce, saving you time and effort. This scalability ensures that your payroll processes remain efficient and accurate, even as your business flourishes.