Role of Pay Stubs for Businesses – A Comprehensive Guide

In the intricate tapestry of business operations, creating pay stubs stands out as a critical practice that goes beyond being a mere administrative task. Pay stubs, also known as paychecks or pay advice, serve as detailed documentation of an employee’s earnings and deductions for a specific pay period. In this article, we will delve into why creating pay stubs for businesses is not just a regulatory requirement but an essential practice that brings transparency, compliance, and several other benefits to the forefront.

1. Financial Transparency

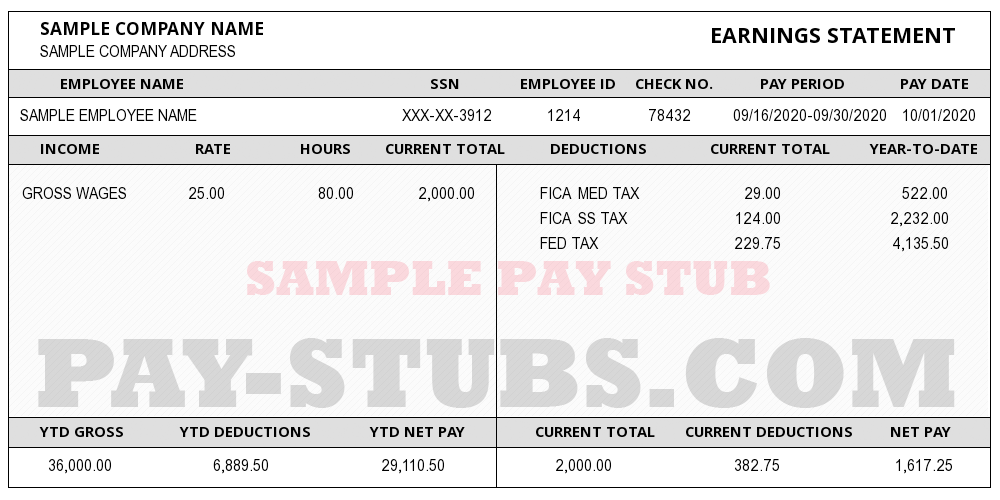

One of the primary reasons why creating pay stubs is essential for businesses is the establishment of financial transparency. An online pay stub provides a detailed breakdown of an employee’s earnings, including gross pay, deductions, and net pay. This transparency fosters trust and ensures that employees have a clear understanding of how their compensation is calculated. In turn, this can contribute to a positive work environment where employees feel valued and informed about their transactions with the company.

2. Legal Compliance

Creating pay stubs is not just a best practice; it is often a legal requirement. Many jurisdictions mandate that employers provide accurate and detailed pay stubs to employees. Failure to comply with these regulations can lead to legal consequences and penalties. By generating and distributing pay stubs, businesses ensure that they are adhering to local labor laws, avoiding potential legal pitfalls, and demonstrating a commitment to compliance.

3. Employee Verification and Confidence

When employees get paid their salaries, they have solid proof of their earnings, taxes, and deductions. This documentation becomes crucial in various situations, such as when applying for loans, renting apartments, or verifying income for other financial transactions. The existence of a comprehensive pay stub instills confidence not only in the employee but also in external entities dealing with the employee, such as financial institutions or landlords.

4. Detailed Earnings Breakdown

Pay stubs go beyond just stating the net pay; they provide a detailed breakdown of earnings. This breakdown includes regular hours worked, overtime, bonuses, and other forms of compensation. For employees who are paid based on hourly rates or have variable compensation structures, a detailed earnings breakdown is invaluable. It ensures that employees understand how their pay is calculated and helps in resolving any discrepancies or concerns.

5. Tax Reporting and Planning

Creating pay stubs facilitates the tax reporting process for both employers and employees. Employees can refer to their pay stubs for accurate information on taxes withheld, making the process of filing tax returns smoother and more efficient. For employers, maintaining detailed payroll records, including pay stubs, is crucial for tax reporting and compliance with tax regulations. It also aids in strategic tax planning for the business.

6. Record-keeping and Audits

Pay stubs serve as a vital component of record-keeping for businesses. In the event of audits, whether internal or conducted by external entities, having accurate and detailed pay stubs provides a comprehensive view of the payroll process. It helps in verifying the accuracy of payments, ensuring compliance with labor laws, and addressing any discrepancies that may arise during the audit process.

7. Benefits and Deductions Documentation

In addition to salary or hourly wages, pay stubs document other crucial aspects of employee compensation, such as benefits and deductions. This includes contributions to health insurance, retirement plans, and any other voluntary deductions. Having a record of these details is essential for both employees and employers to track and manage overall compensation packages effectively.

Conclusion

In the modern business landscape, where regulatory compliance, financial transparency, and employee satisfaction are paramount, creating pay stubs has evolved from being a mundane administrative task to a strategic imperative. Beyond the legal requirements, pay stubs contribute to a positive workplace culture, foster trust between employers and employees, and streamline various aspects of financial management. Businesses that prioritize the creation and distribution of accurate and detailed pay stubs not only fulfill their obligations but also invest in building a foundation of trust and efficiency within their organizational framework.

Visit Pay-stubs.com for fake tax return generator today!