What is a Pay Stub? A Comprehensive Guide on How to Make Paystubs for Employees

If you are new to payroll as an employer, calculating the salary of the employees, along with correct deductions and the number of hours worked, is a difficult task. As an employee, you have experienced payroll, but understanding the foundations can also help you choose the best pay stub solution for your business.

In this blog, you will get deeper insights into the essential basics of pay stubs so that you can create one on your own with confidence.

What is a Pay Stub?

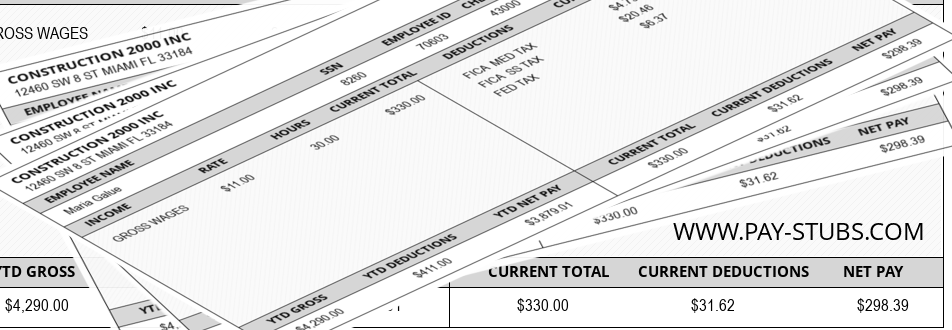

A pay stub, also popularly known as a pay slip or check stub, is a record that confirms an employee’s payment. It is a piece of paper that an employee receives alongside their paycheck, and it contains their personal information such as gross pay and net pay, their present pay rate, the number of working hours during the pay period, and any relevant deductions.

Who Benefits from Pay Stubs?

- Employers

Employers are required to file and issue pay stubs to their employees. These pay stubs are used to compare wages, expenses, and labor records of the employer, as the total amount of all pay stubs is checked. In addition to being a calculation tool for accounting records, pay stubs are essential for complying with state regulations.

- Employees

Self-employed individuals do not need to worry about creating a pay stub. Pay stubs have various benefits for employees, such as record-keeping. Employees need to submit their pay stubs as proof of income on various occasions, such as when applying for a loan where the document is a key evaluation criterion. A pay stub is proof of employment and the amount of salary drawn, and it serves as evidence of taxes paid by an individual, which can also be used as a reference for the next tax cycle.

- Self-employed Individuals

It is crucial for self-employed individuals to keep their personal and business expense records separate to facilitate filing taxes accurately. This ensures that the right business profit is reflected for tax computation purposes.

Self-employed individuals will require pay stubs as proof of income, including small and large corporations of all types, sellers, and individuals doing small but essential jobs such as plumbers, carpenters, tree service firms, landscapers, and entrepreneurial firms.

A Comprehensive Guide on How to Make Paystubs for Employees

Advanced software has taken over almost all sectors, including payroll management, and employers are now replacing traditional accounting services with pay stub generator software. This straightforward system is also being used by employees and independent contractors to create their own pay stubs. However, the information required to create a payroll check stub may vary from state to state.

The following information needs to be filled in the pay stub form to instantly generate the pay stubs for employees.

A pay stub typically includes the contact information of the employer, including the company name, detailed address, contact number, and Employer ID Number. It also includes the contact information of the employee, such as their name, place of residence, Social Security Number, Taxpayer Identification Number, or Individual Taxpayer Identification Number.

Other information found on a pay stub includes the employee’s hourly wages, which may differ for night shifts and holidays, as well as the total number of hours worked and any overtime hours put in. It may also indicate paid time off, bonuses received, and gross wages before tax deductions.

The list of tax deductions may include state, federal, local, Medicare, Social Security, FICA taxes, and employee benefits. The pay stub may also provide for back pay wages in case any errors occurred in the past, leading to less payout. Finally, the net wages or the amount left after tax deductions and other contributions are also included.

Using software for creating pay stubs can be a time-saving process. The software can calculate taxes based on the employee’s state of employment and withhold the amounts accordingly. It can also calculate the gross, net, and year-to-date balances for the current pay period.

Conclusion

Pay stubs are a crucial aspect of any employment agreement. They provide employees with vital information about their earnings, taxes, and benefits. Employers can also use pay stubs as a tool for record-keeping, accounting, and compliance with state and federal laws. At Paystubs, we provide simple, reliable, and cost-effective pay stub generator services that cater to businesses of all sizes and individuals. Our user-friendly interface guarantees that you can generate customized pay stubs within seconds.